Fairy Dust for Pixie Dust

Do We Live in a Rational Economy?

2021:Juni //

The gold standard was widely used in the 19th and early part of the 20th Century, as a national monetary exchange system supported by a nation’s gold reserves. Nations have since abandoned the gold standard, while still holding substantial gold reserves. The size of the U.S. economy was expected to reach $22.32 trillion in 2020. But the market value of United States gold reserves as of September 2020 was only $388.4 billion. The U.S. owns the most gold of any nation with a reserve of gold equaling 8,133 tons. Germany is second with 3,369 tons worth more than $154 billion.

The “gold specie standard” is a service in which money is exchanged in the form of coins made from gold. With the invention of paper money, gold coins were replaced by banknotes, creating a system in which gold coins are no longer in general circulation.

Paper money is known as Fiat Money. The U.S. dollar is fiat money, as are the Euro and many other major world currencies. The value of fiat money is not determined by the material with which it is made. The metals used to mint coins and the paper on which to print bills are not valuable in themselves. Fiat money has value only because a government maintains its value. Does “fiat” mean fake? Is fiat money nothing more than Fairy Dust? Can the worth and value of paper money be underpinned by some physical commodity such as artwork?

Decisions are made by all kind of investors, from private individuals to professional investors at the Frankfurter Wertpapierbörse or the U.S. Wall Street stock exchange, and covers all spectrums of economic activity. A variety of influences can affect a person’s investment behavior, such as building or loosing wealth. How people think determines the limits of arbitrage. Arbitrage is the simultaneous buying and selling of commodities in different markets in order to take advantage of differing prices for that same item – to make a profit. However, investors are not always rational. The influence of psychology on the behavior of art collectors, for example, reinforces the reality that investors are influenced by their personal or cultural biases.

Female artists had been a relative rarity in the top art galleries, and the most famous artists through out most of Western art history were all men. The price of artwork is somewhat related to the stages of an artist’s career, age, and articles in serious art publications. According to conventional wisdom, the value of an artist’s work increases when he or she has exhibitions in prestigious venues such as major museums. How does one judge the value of a female’s artwork relative to a male’s? The contemporary art market has at least one simple answer: price. And from that perspective, the comparison is unmistakable: art made by women is regarded less highly than art made by men. Women’s art sells for less because it is made by women.

Fiat money is “Fairy Dust” and artworks are “Pixie Dust.” Fiat money as fairy dust refers to a hypothetical substance (a magical powder) that will give value to whatever it is sprinkled upon - including artwork. Pixie dust is associated with pixies (artists) - who employ artistic powers to work magic. Important artwork are magical glittering objects that grant the collectors the abilities of psychic levitation. Artworks produced by certain artists function like a very strong hallucinogen with dissociative properties that affects the senses and the perception of reality. Collecting artwork yields intangible gains such as status and the reputation of sophistication.

“Why do you like this one? What is important to you about that one?” It is not rational to be an art collector. The Norwegian Erling Kagge describes art collecting as an obsession – something you have to believe in. The late British art collector Alistair McAlpine said some people described collecting as a disease. On his behalf, he said collecting is an instinct.

The prices placed on artwork are often perceived as inflated and irrational. But it is important to note that unlike most commodities artwork has little to no substitute, for there is only one painting called “Mona Lisa.” You may purchase posters and reproductions but nothing will substitute for the original. It is due to this reality that Adam Smith, the Scottish pioneer of political economy (also known as “The Father of Capitalism”), believed it was impossible to place a value on artwork. Today, the art collector is not your traditional connoisseur. They do not simply purchase an interesting artwork, they want to make money with it as well. There is no guarantee that an artwork is going to increase in value. Value can be affected by everything from sales price history to the story and life (gender and ethnicity) of the artist. Theft and forgery are also a problem in the high-stakes art market. Some say a third of all artwork offered for sale are not by the artists to which they are attributed.

The art market is tiny, and Germany plays a very minor role in it. The number one art market in the world is New York City. Germany has the strongest economy in Europe, a large collector base, a substantial gallery network, and is represented by star artists such as Gerhard Richter, Markus Lüpertz, and Georg Baselitz. Consequently, Germany has a legal framework that has hindered its art trade. The German Federal Council (Bundesrat) approved the Act on the Protection of Cultural Property, under which all artwork with a certain heritage, worth more than a number of Euro, would require an export license to be sold abroad. This law resulted in the move of entire European art collections to warehouses outside of New York. Art experts have criticized the Cultural Property Protection Act. Kilian Jay von Seldeneck, then director of the Berlin branch of the auction house Lempertz, predicted in 2015 on artnet.com the regulation would be “fatal” and that “it would simply mean the end of the art market in Germany.” The art market continues to exist in Germany, and players continue to actively participate in it, however they no longer operate from within Germany.

A collector may have a fascination with owning a piece of history (antiquity). One aspect of the Cultural Property Protection Act was intended to preserve German archaeological heritage. The Kingdom of Prussia (Königreich Preußen) was a historically prominent German state that originated in 1525. The Kingdom of Prussia was formally abolished by the Allied Control Council Enactment No. 46, in 1947. In 2020, a 1910 Prussen, Kaiserreich 20-Mark gold coin with the portrait of the German emperor Wilhelm II, weighting 7.96 g, was selling for 440.00 Euro. 7.96 g equals 0.0175 U.S. pounds. 440.00 EUR equals approxamately 533.94 U.S. Dollars. The price of the gold in that one coin, based on the weight of the coin, relative to the selling price, is 385.37 Euro ($492.11) in Fiat Money! The gold coin thus regained its status as “commodity money”, almost at the same value. But you can’t pay with it, you can sell it as an antique or melt it and sell it as pure gold …

20 Reichsmark in Gold mit Wilhelm II. von 1910, entspricht einer Kaufkraft von heute ungefähr 100 Euro

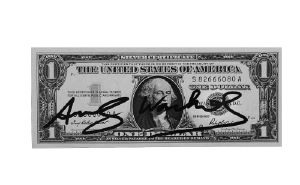

Andy Warhol, „One Dollar Bill Washington“, signed, ca. 1963